Skift Take

Low-altitude tourism seems like more than a passing trend in China. As government policies align with private innovation, Chinese skies may soon become a bustling hub of economic and cultural activity.

The name needs some work, but the trend seems real: âLow-altitude economyâ refers to activities within airspace under 1,000 meters â think helicopter rides, paragliding, goods transported by drones and now, flying taxi-powered sightseeing.

A new deal between EHang Holdings and Chinaâs Zhejiang Sunriver Culture and Tourism highlights the idea. EHang Holdings operates electric vertical take-off and landing (eVTOL) aircraft.

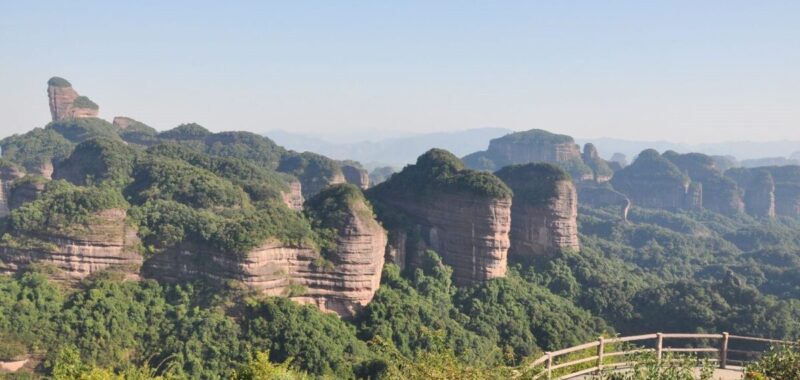

Sunriver has over 40 tourist destinations, including sites like the Bailong Elevator and Huanglong Cave in Hunan Province, Bifeng Canyon in Ya’an City, and Danxia Mountain in Guangdong Province. By introducing eVTOL aircraft to these locations, Sunriver aims to create a smart tourism model, starting with five units and scaling up to 50.

The latest collaboration isnât just about sightseeing. Itâs a testbed for integrating autonomous technology into everyday travel.

Low-Altitude Economy in China

Earlier this year, Chinese e-commerce platform Meituan launched Beijing’s first regular drone delivery service at the Badaling Great Wall, allowing tourists to receive packages of food and medication.

The Badaling Great Wall does not allow commercial facilities to operate in the area to preserve its original appearance, leaving visitors with limited access to essentials like water and food.

To solve this, the authorities teamed up with Meituan to launch Beijing’s first drone logistics route. Visitors can scan a QR code, order necessities like medicine, water, or food, and receive them via drones in as little as five minutes. And all this for a delivery fee of only RMB 4 (55 cents).

Since China’s State Council encouraged low-altitude economic development in 2014, the sector has flourished. As of mid-2024, 29 provinces, from Guangdong to Inner Mongolia, have incorporated the low-altitude economy into their development plans. This includes initiatives to simplify airspace management and expand infrastructure, creating a fertile ground for private players like EHang to innovate.

Policy Backing: Driving Growth from the Ground Up

Chinaâs government policies aim to streamline airspace regulations and enhance connectivity between cities and airports. For example, Beijingâs plans include establishing routes from its major airports to surrounding regions, while Suzhou is developing an aerial corridor connecting the city with surrounding airports for regional transport.

At a broader level, the governmentâs work report for 2024 emphasizes fostering new industries like the low-altitude economy, which is projected to surpass RMB 1 trillion ($140 billion) by 2026. A report on the development of China’s low-altitude economy released this year by the China Center for Information Industry Development under China’s Ministry of Industry and Information Technology shows that in 2023, China’s low-altitude economy scale exceeded RMB 500 billion ($69 billion).

Cities like southern tech hub Shenzhen city have also released a document seeking public opinion on funding companies to get airworthiness certification for their eVTOL aircraft and drones, opening short-distance air routes, and establishing infrastructure.

Last week, the ministry of industry and information technology held its first meeting dedicated to the emerging low-altitude economy.

Cultural Tourism Connection and Challenges

Low-altitude tourism isnât just about thrills. Besides welcoming over 24,000 visitors since its inaugural flight in 2021, the Yanzhou Island Aviation Sports Tourism Camp in Zhaoqing has also hosted over 100 aviation science and educational events.

Similarly, Danxia National Geological Park has expanded from helicopter tours to hot air balloon carnivals, drawing over 50,000 visitors annually.

While the potential is immense, challenges remain. Regulatory frameworks need refinement to accommodate new technologies like eVTOLs. Infrastructure, particularly in less developed regions, requires significant investment. Moreover, public acceptance of autonomous vehicles for passenger use will take time, necessitating extensive safety demonstrations and marketing efforts.

An industry group recently pointed out that while investors are excited about Chinaâs low-altitude economy, the sector is struggling to grow due to a lack of clear information and direction.