Travel agents are optimistic about China’s outbound tourism rebound, and they predict a full recovery by 2025, according to Dragon Trail’s latest Chinese Outbound Travel Trade Survey to be released later on Wednesday.

This optimism comes as agents tap into new sales channels, adapt to shifting demographics, and navigate the evolving expectations of Chinese travelers.

Recovery will be uneven across regions, with Asia being the quickest to recover due to proximity and visa waivers. However, agents expect North America’s recovery to lag until 2026, hindered by the slow restoration of flights.

Over 70% of agents expect China’s improving economy to boost outbound travel in 2025. Despite the economic optimism, price sensitivity remains a key factor. Even as Chinese travelers returned to their status as top spenders in 2023, they are still cautious about their spending.

Nearly half of agents cite high travel costs as a barrier, but international tensions — especially safety concerns — pose a greater threat to outbound tourism.

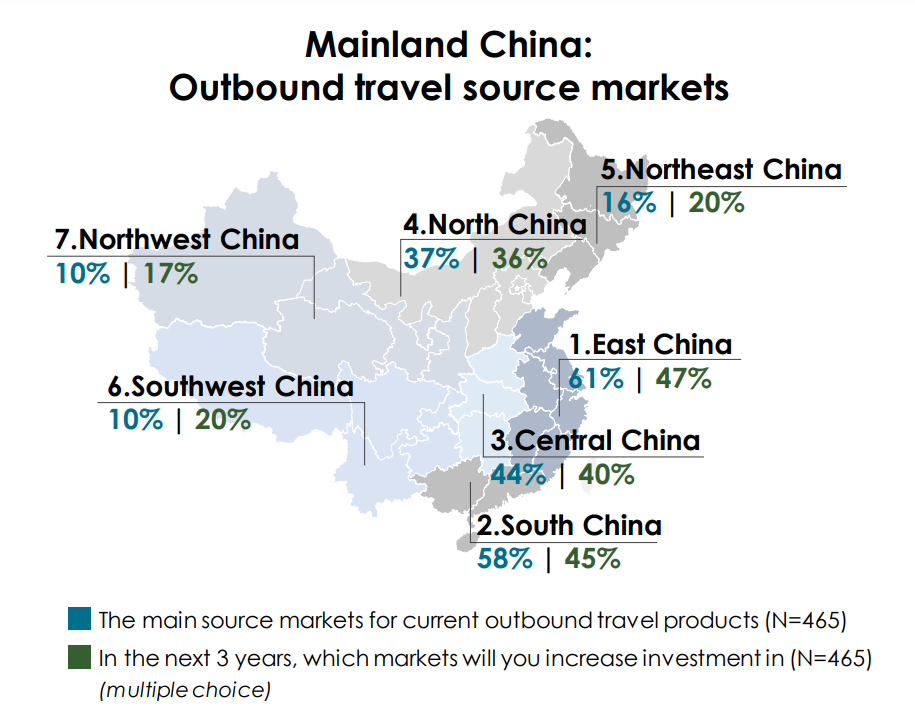

The most important outbound travel source markets are East China, home to Shanghai and Hangzhou; and South China, including Guangzhou and Shenzhen. Travelers in these areas are also most likely to increase investment over the next three years, according to the survey.

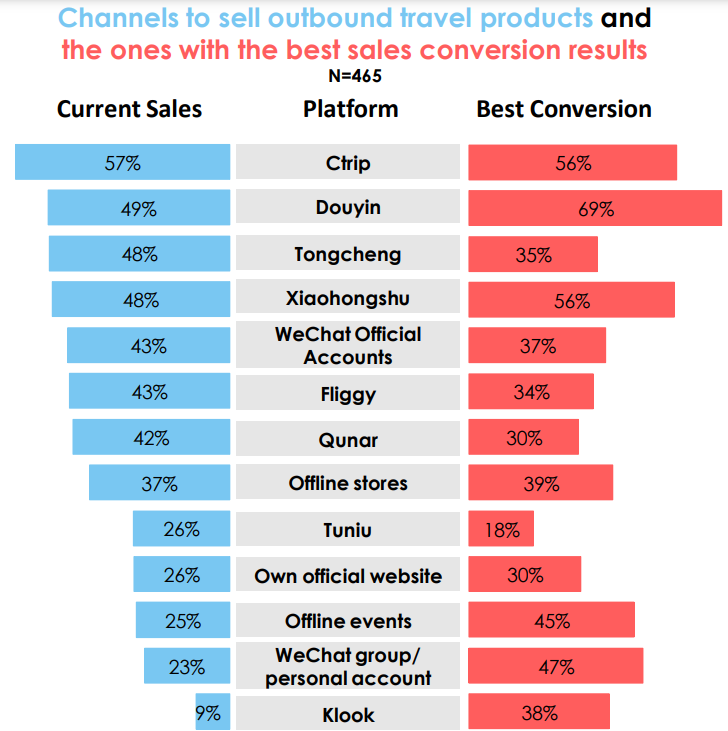

Social media is reshaping how travel is marketed and sold in China. Platforms like Douyin and Xiaohongshu, with their short video and community-driven formats, enable agents to showcase destinations in creative ways.

These platforms also drive direct bookings, alongside traditional travel companies like Ctrip. Nearly half of the surveyed agents said they have embraced social media platforms like Douyin and Xiaohongshu for travel sales, and conversion rates are above average.

Additionally, WeChat remains indispensable for direct sales, with agents leveraging group chats and personal accounts to connect with clients.

Luxury Travel: A Three-Tiered Market

China’s luxury travel market is highly segmented, with distinct groups seeking unique experiences.

Retirees and Pre-Retirees: These travelers, primarily from the post-60s and 70s generations, seek relaxation and cultural enrichment. Popular options include river cruises, private guided tours, and immersive activities like cooking classes.

High-Income Professionals: Post-70s and 80s corporate elites prioritize exclusivity and family-focused travel. Multi-generational trips, private island vacations, and spa retreats are staples in their itineraries.

Young High-Spenders: The post-90s and 00s generation, with careers in tech and finance, seeks “brag-worthy” experiences. They are drawn to polar expeditions, luxury safaris, and bespoke adventure tours.

Chinese-Language Services: A Key Differentiator

Chinese-language services remain vital for travel suppliers targeting the outbound market.

Whether a hotel can offer Chinese-language services is one of the top factors Chinese travel agents consider when choosing partners to work with, and Chinese language services and Chinese catering are both in demand for travel products.

The importance of Chinese-language service is also reflected in Dragon Trail’s consumer research – its April 2023 survey found that Chinese-speaking staff were the second most important factor for consumers when choosing a hotel overseas (after location), picked by more than half of the travelers.

Silver Travelers: The Untapped Potential

An emerging segment in China’s outbound tourism is its “silver travelers.” This growing demographic of retirees, often supported by pensions and ample leisure time, is increasingly exploring international travel. Unlike younger tourists, they are less focused on cost and more on comfort, safety, and personalized experiences.

To cater to this market, travel providers must adjust their offerings. Key factors like medical support, easy-to-navigate itineraries, and specialized care are essential for ensuring positive experiences.

As one travel agent highlighted in the survey, “The silver group is a new segment that the outbound tourism market should focus on. They’re in the prime of their retirement, relishing their golden years. Right now, elderly tourism remains a largely untapped opportunity.”

Skift had reported last year in August how China’s senior travelers have spent over RMB 1.6 billion ($224.6 million) on Trip.com Group’s platform. To cater to this demographic, the group has also launched the Old Friends Club, targeting those aged 50 and above.