Skift Take

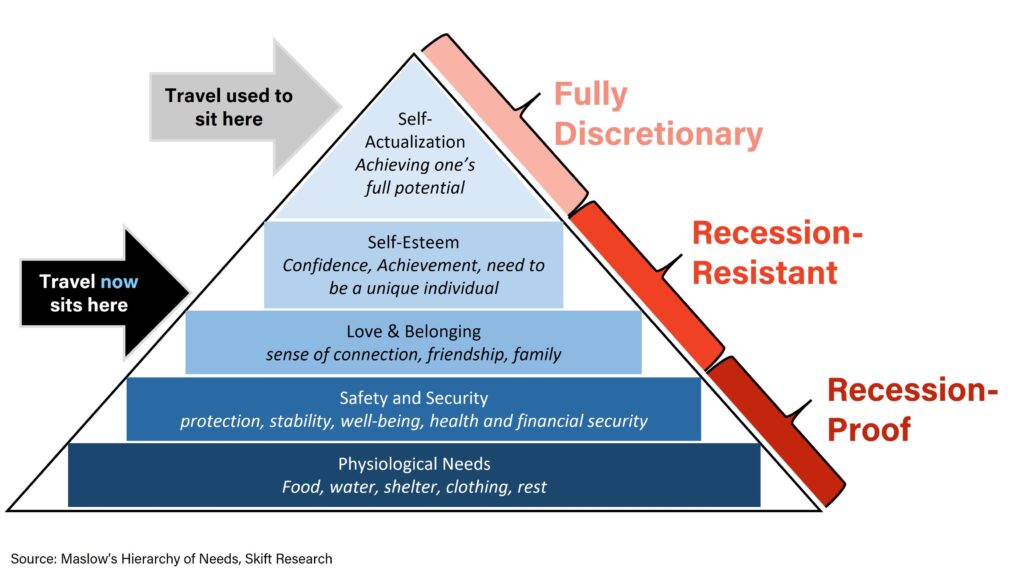

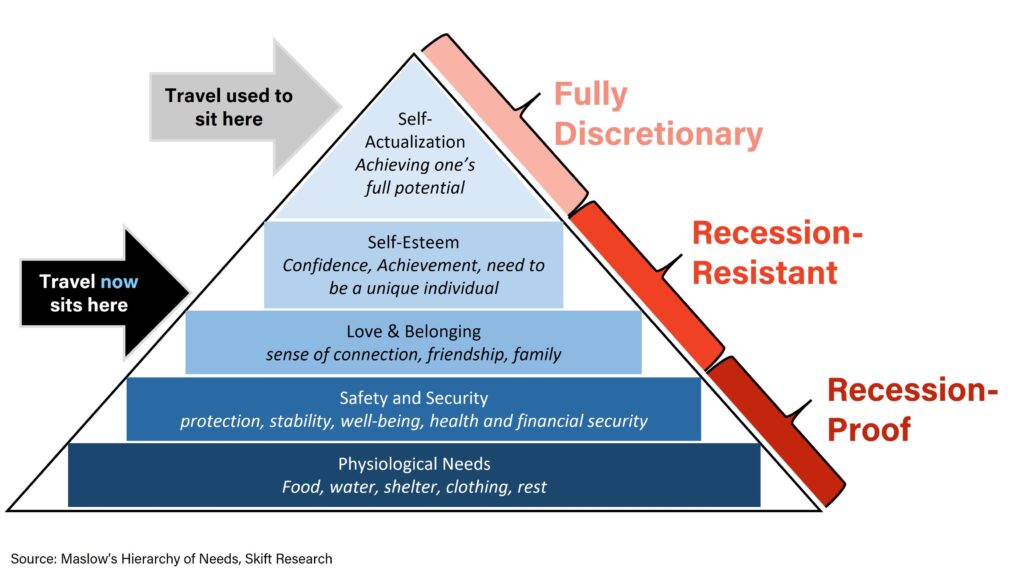

Travel, as a discretionary item, will never be fully immune to the impacts of a recession. But in today’s environment, travel could be more recession resistant, if not fully recession proof.

Last month, we wrote about how a potential recession in the U.S. could impact the travel industry. The concern has been that a recession would hit travel spending and you can see it in the stock market: The Skift Travel 200 Stock Index is up only 3% since the start of the year while the global market is up 20%.

Revenues and profit margins have largely recovered to pre-Covid levels, but travel executives were pointing to a slowdown in demand on recent earnings calls. Here’s how some companies described the environment:

- Hilton: [We have] “tempered the high end of our expectations versus prior guidance due to softer trends in certain international markets and normalizing leisure growth more broadly”.

- Expedia: “We’re definitely seeing a reduction in room nights.”

- Airbnb: “We are seeing shorter booking lead times globally in some signs of slowing demand from U.S. guests.”

At the Skift Global Forum last week, Marriott CEO Anthony Capuano said that even high-income consumers â who’ve been driving travel spending â had “just a little bit of a pullback in ancillary spending on food and beverage and spa.”

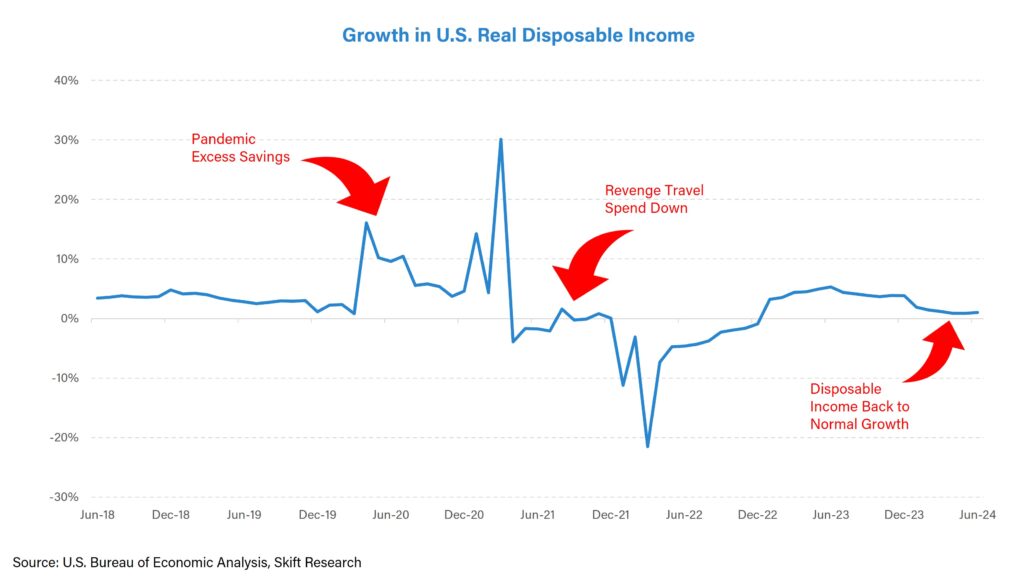

The slowdown can be largely explained by an end of Covid-era tailwinds: Consumers have spent their excess savings throughout the pandemic and growth rates have largely normalized to pre-pandemic levels.

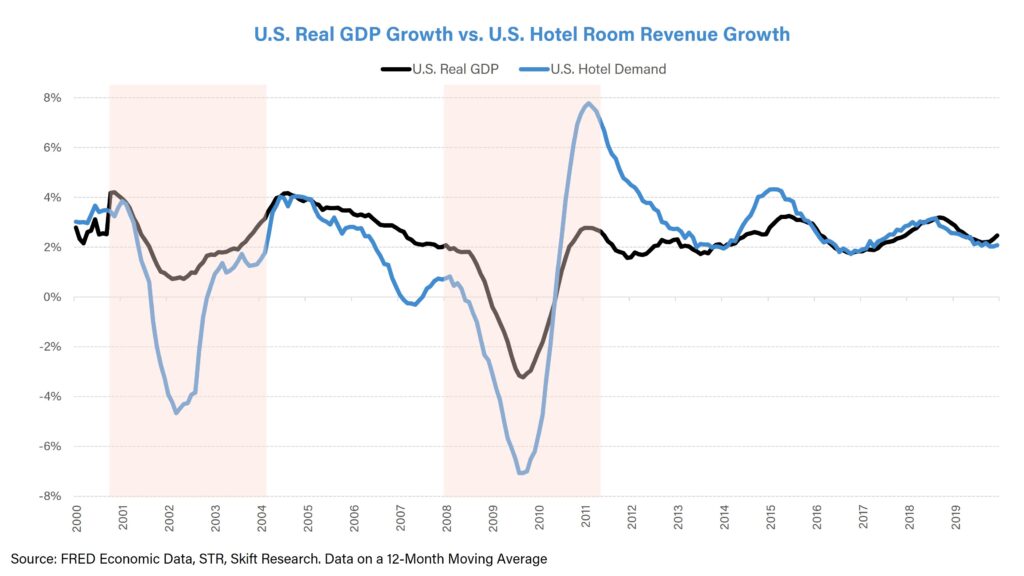

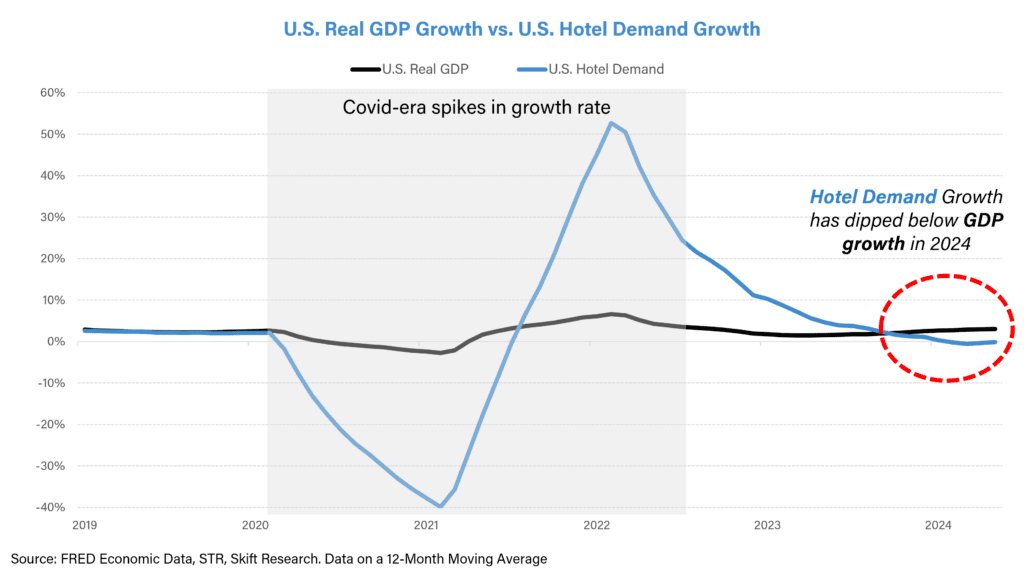

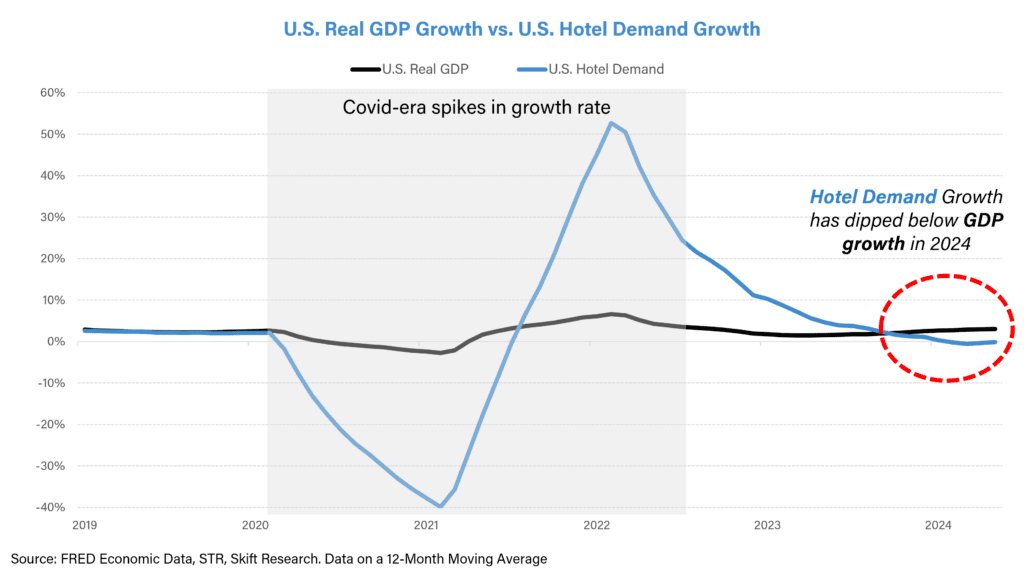

There are also signs that the travel industry is lagging behind overall growth in the U.S. economy, indicative of early signs of a potential recession. U.S. hotel demand growth typically trends in line with GDP growth. In a recession, it typically falls by much more.

This year, we can see that hotel demand growth has slowed down below GDP growth.

It’s unclear whether the U.S. will officially enter recession. If it does, it is likely that travel will be impacted.

In previous recessions, such as in 2008/09, hotel demand dropped by more than double the decline in GDP growth. But we believe that travel today could be a little more insulated than it has been in the past: Call it “recession-resistant” â though not fully “recession-proof.”

What does a recession-resistant travel industry look like?

A recession-resistant industry is one where travel has become more important to consumers than ever before.

We believe that travel has moved down Maslowâs hierarchy of needs. Pre-Covid travel was a fully discretionary item, sitting at the top of the pyramid.

Post-Covid, travel has become an important tool for making connections and finding a sense of belonging in our lives. It has gone from being fully discretionary to being a more fundamental need.

A recession-resistant industry is one where consumers have become more sophisticated shoppers.

Skift Research’s U.S quarterly consumer tracker shows that higher prices are impacting consumers. Our survey work shows that 67% of consumers had their vacation plans impacted by higher prices in the first quarter.

If there is an economic downturn where consumers are affected by rising prices, we might see consumers turn to programs such as loyalty and credit card programs to get more value for their money.

But it’s not just about cost. Service has become just as important. Consumers have become savvier shoppers, signing up for many loyalty programs, not because they are necessarily loyal to those brands, but because they are trying to score as many perks and rewards as they can.

A recession-resistant industry is one where consumers have much more choice to shop around due to a more fragmented distribution landscape.

Today, there is a changing and fragmenting distribution landscape that is seeing the entrance of strong new competitors that didn’t even exist 5 years ago. This is giving consumers much more choice.

We believe one company that is contributing most to a more fragmented landscape is Google. Ever since Google introduced free listings to its hotel search platform in 2021, consumers have been discovering new and smaller OTAs, as well as the direct site, in a much more prominent way than before when it was just paid sponsored results on Google.

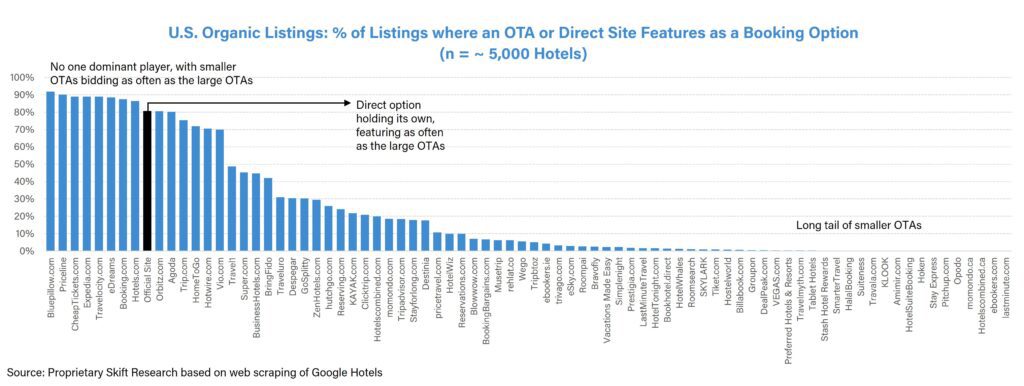

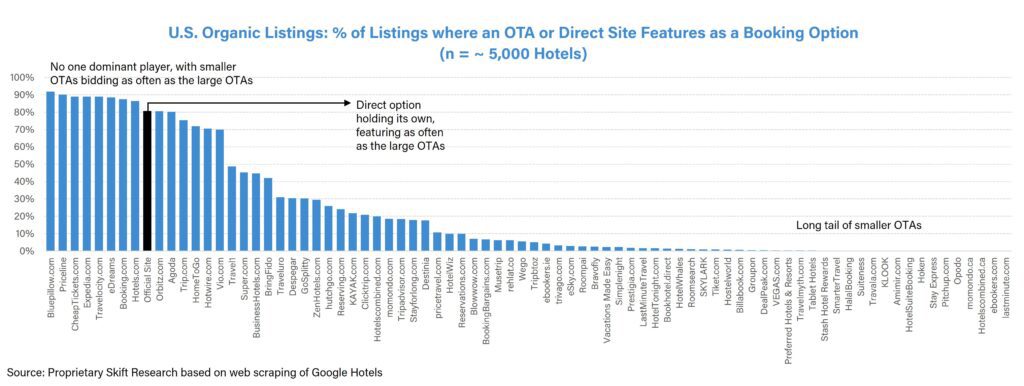

As we show in A Deep Dive into Google Travel Part I: U.S. Hotel Distribution, though the paid results – unsurprisingly – are dominated by the large players Booking Holdings and Expedia Group, in Googleâs organic listings, itâs a different story.

The chart belows shows how frequently companies feature on Google’s organic listings. We can see that in the organic search, there is no one dominant player and there is long tail of small OTAs all competiting for bookings.

The introduction of organic listings has therefore allowed a democratization of online search and has facilitated a more competitive distribution landscape.

Yes, if there is a recession in the U.S., the travel industry will feel the impact. But while travel spending is still discretionary, it has become less so. In addition, the consumer has more power than ever before. And companies have to be hyper-focussed on generating new ideas, adapting to the new wants and demands of a modern travel consumer, and finding new ways to deliver value for money … or risk being left behind.