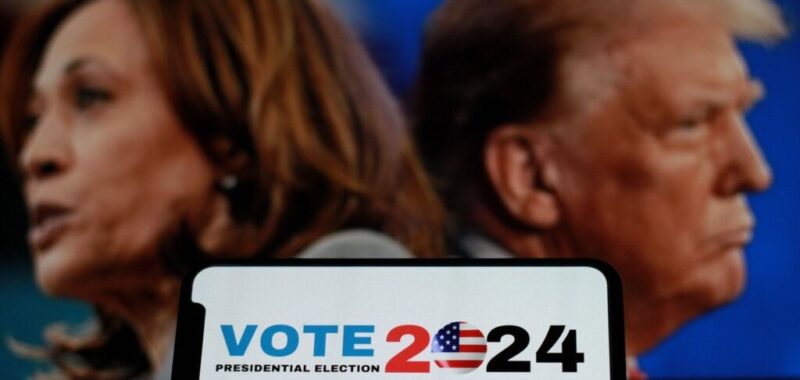

Algorithmic trading firm Wintermute has announced the launch of OutcomeMarket, a decentralized prediction market platform that will initially focus on the 2024 U.S. presidential election with tokens tied to candidates Donald Trump and Kamala Harris.

Launching next week, the platform allows users to participate directly in prediction markets across Ethereum (ETH) and its layer-2 scaling networks Base and Arbitrum, and eliminates the need to bridge assets between chains.

OutcomeMarket’s platform will be driven by permissionless smart contracts—which hold the code that powers decentralized apps (dapps)—meaning any trading venue can list its tokens without imposing minting or transaction fees.

According to Wintermute CEO Evgeny Gaevoy, the platform aims to create a more accessible and efficient market by reducing barriers to entry. The initial token offering will feature TRUMP and HARRIS, allowing users to vote on the candidates’ performance in the election while also using the tokens in decentralized finance (DeFi) applications across multiple exchanges.

“There has been significant interest from both centralized and decentralized trading venues to list such prediction market contracts, but no one had developed them in a permissionless manner and without imposing minting or transaction fees,” he wrote.

The platform will utilize Chaos Labs’ Edge Proofs Oracle to ensure data integrity and reliability across the chains. Several trading venues, including Bebop, WOO X, and Backpack, have already committed to listing the OutcomeMarket tokens.

Political meme coins and prediction markets have gained traction in recent years, blending cryptocurrency speculation with political forecasting. In 2020, the FTX derivatives exchange launched similar prediction markets for the US presidential election, which saw significant trading volume. FTX, of course, then collapsed amid fraud allegations.

Prediction markets like PredictIt and Polymarket have also faced regulatory scrutiny, with Polymarket paying a $1.4 million civil monetary penalty in 2022 to settle CFTC charges. Polymarket has surged in popularity and trading volume over the course of 2024 due primarily to interest in election betting pools.

Edited by Andrew Hayward